Homeowners Insurance in and around Aurora

Looking for homeowners insurance in Aurora?

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Aurora

- Denver

- Greenwood Village

- Castle Pines

- Castle Rock

- Englewood

- Thornton

- Northglenn

- Brighton

- Lone Tree

- Lakewood

- Centennial

- Louisville

- Boulder

- Lafayette

- Greeley

- Evans

- Plattsville

- LaSalle

- Longmont

- Ft Morgan

- Loveland

- Golden

Insure Your Home With State Farm's Homeowners Insurance

Everyone knows having fantastic home insurance is essential in case of a fire, ice storm or blizzard. But homeowners insurance is about more than covering natural disaster damage. Another helpful thing about home insurance is its ability to protect you in certain legal situations. If someone has an accident on your property, you could be on the hook for their hospital bills or physical therapy. With enough home coverage, your insurance may cover those costs.

Looking for homeowners insurance in Aurora?

Help protect your home with the right insurance for you.

Open The Door To The Right Homeowners Insurance For You

State Farm's homeowners insurance is the way to go. Just ask your neighbors. And contact agent Denise Smith for additional assistance with getting the policy information you need.

So visit agent Denise Smith's team for more information on State Farm's excellent options for protecting your home and valuables.

Have More Questions About Homeowners Insurance?

Call Denise at (303) 343-3515 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

Pet hazards

Pet hazards

If you take a look around your space, you will likely find household items dangerous for dogs & things toxic to cats. Help protect your pet with these tips.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Collectibles insurance and appraisal tips

Collectibles insurance and appraisal tips

Follow these steps and have a collection appraisal to make sure you have the right amount of collectibles insurance.

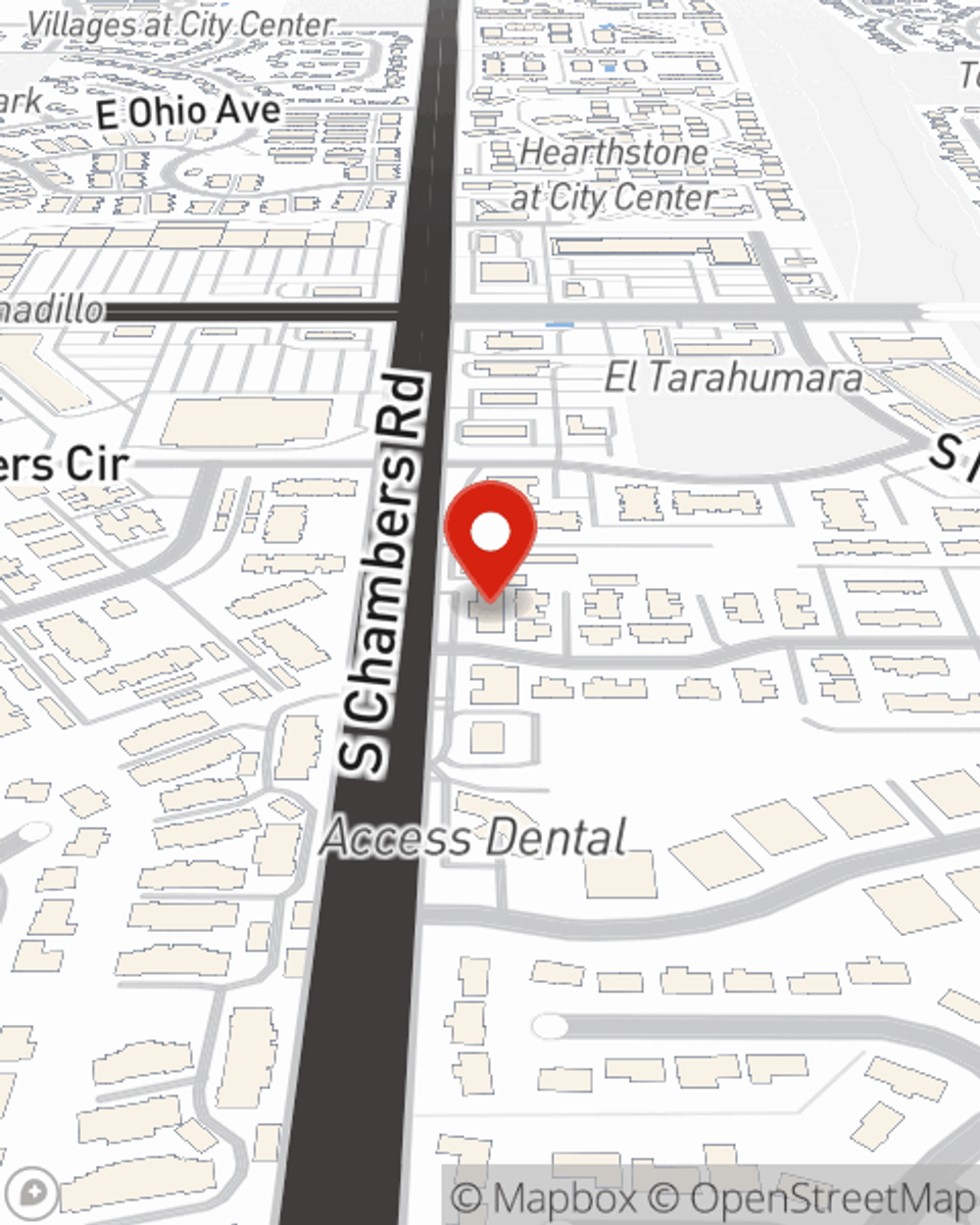

Denise Smith

State Farm® Insurance AgentSimple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

Pet hazards

Pet hazards

If you take a look around your space, you will likely find household items dangerous for dogs & things toxic to cats. Help protect your pet with these tips.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Collectibles insurance and appraisal tips

Collectibles insurance and appraisal tips

Follow these steps and have a collection appraisal to make sure you have the right amount of collectibles insurance.